Money Matters: Your Questions Answered by Richard Andrews

Richard Andrews spent over ten years working for high-street banks, including time as a business manager supporting small businesses. Today, he runs his own company, coaching executives and individuals to help them achieve the outcomes they want. All of this gives him plenty of real-world insight to share with 2Shades readers.

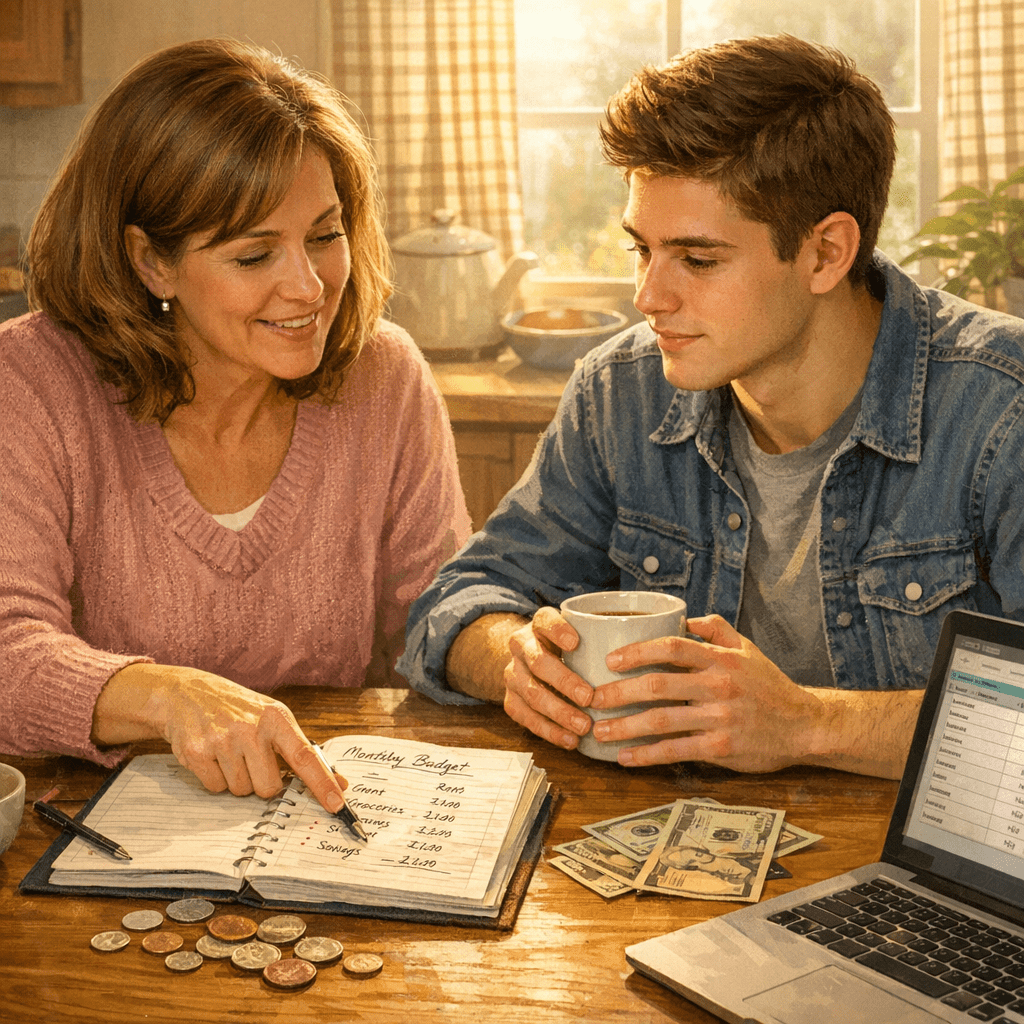

Q: Teaching a Teenager About Money

Brenda, Bournemouth

I want my teenage son to learn about money. He’s 16, and his grandmother gave him £5,000—against my better advice. We support him at home and with college, and he also has a part-time job. How should I advise him to use this money? He’s already talking about holidays and clothes.

A:

This is a tricky one, Brenda—because whatever approach you take, there’s a strong chance you’ll feel like the “bad guy”. That said, this is also a valuable teaching moment.

A balanced approach usually works best. Encourage him to split the money into three parts: savings, sensible future planning, and a smaller amount to enjoy now. Completely denying him any fun spending can backfire, but allowing all of it to disappear on short-term treats isn’t ideal either.

For savings, suggest putting a portion aside for something tangible and motivating—driving lessons, insurance, or even a first car. Without a clear goal, saving can feel abstract, especially to teenagers. When there’s a purpose, it suddenly becomes exciting.

There are some strong, easy-access savings options for young people. For example, the Nationwide FlexOne Saveroffers competitive interest up to a set limit, while HSBC My Savings provides tiered interest rates. Watching interest build can be a great lesson in how money works for you.

If you’re particularly worried about impulse spending, a Junior ISA could be an option. Funds are locked away until age 18, giving the money time to grow and removing temptation. Comparison sites like Money Saving Expert are useful for finding the best rates.

Ultimately, though, it is his money. If he spends more than you’d like, resist the urge to say “I told you so”. Gently guide him back towards saving and goal-setting. Those lessons tend to land better when they’re learned through experience.

Q: Buying Bitcoin as a Gift

Colin, Edinburgh

I’m thinking of buying my boyfriend Bitcoin for his birthday—he’s always talking about it. How much is too little, and how do I go about buying it?

A:

That’s a generous idea, Colin—and a very modern one. It’s worth starting with a bit of context. Bitcoin is expensive and highly volatile. You don’t need to buy a whole Bitcoin; most people purchase a fraction, depending on what they’re comfortable spending.

To buy it, you’d need to open an account with a cryptocurrency exchange such as Coinbase or Crypto.com. You transfer funds in, then place a trade for the amount you want.

However, a note of caution: cryptocurrency is not protected by the Financial Services Compensation Scheme. If the platform fails or the value drops sharply, there’s no safety net.

Personally, I tend to avoid crypto due to its price swings, so it’s not something I’d actively recommend. But as a gift, especially for someone who understands and enjoys the space, a modest amount can make sense. Think of it more as a speculative present than a traditional investment.

Q: Teaching Children to Save and Invest

Paula, Southend

What was your earliest way of saving? I want to teach my children how to save and invest.

A:

Paula, this is a brilliant question—and you’re doing your children a huge favour by thinking about this early.

I’ll be honest: I wasn’t good at saving when I was younger, and I’ve spent a lot of time catching up. The key lesson I’ve learned is that habits formed early matter enormously.

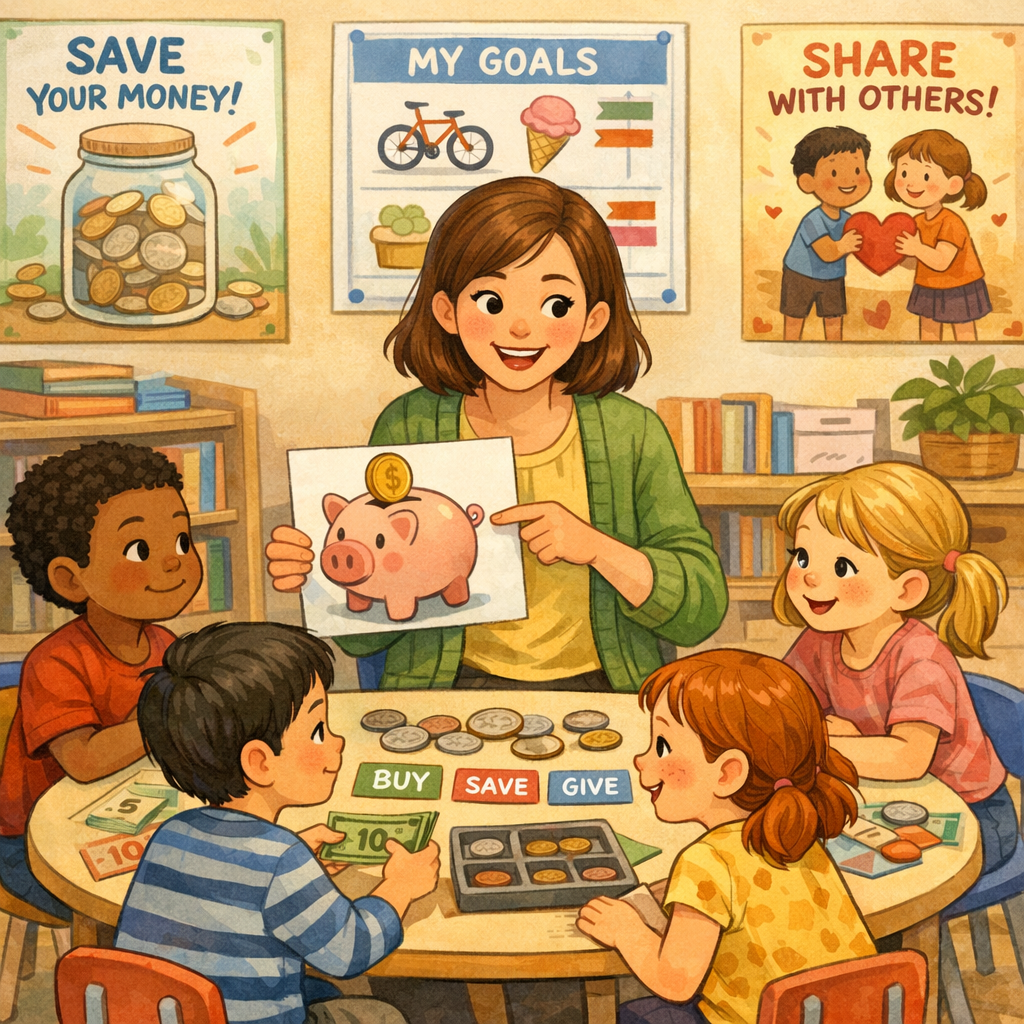

Simple methods work best. A child’s savings account, a piggy bank or jar for coins, and regular conversations about money can be incredibly effective. Counting coins, bagging them up, and taking them to the bank helps children see money as something real and manageable.

Goals are essential. Help your child save towards something—a toy, an experience, or a future plan. Saving feels far more meaningful when it leads to something tangible.

There are also child-friendly banking apps that allow kids to track savings and spending, though some come with monthly fees—so check whether they’re actually adding value. And don’t forget Junior ISAs, which lock money away until age 18 and can be a powerful long-term tool.

Q: Premium Bonds vs Lottery Tickets

Are Premium Bonds a better investment than buying lottery tickets?

A:

In short—yes, but they’re not the same thing.

Lottery tickets are gambling. Once the money’s spent, it’s gone. Premium Bonds, on the other hand, are a form of saving. You can invest from £25 up to £50,000, and you can withdraw your money if you need it.

Instead of interest, you’re entered into monthly prize draws. I’ve had a few wins myself, and in some cases they’ve outperformed traditional savings accounts. That said, for consistent growth, using your tax-free ISA allowance is often a better option.

Q: Saving for a Holiday Without Spending It

Mark Brighton

I want to save for a holiday in June, but I’m hopeless with money. How do I save and stop myself dipping into it?

A:

Mark —you’re definitely not alone. This comes down to two things: control and motivation.

Start with a simple budget planner so you know exactly what’s coming in and going out. Separate essentials from “nice-to-haves” and work out what you can realistically save each month. Many banks offer budgeting tools and savings “pots” within their apps—Monzo and Virgin Money are good examples.

If self-control is the biggest issue, you need to tackle the why. What triggers the spending? And what would you rather have more: a short-term splurge, or that holiday in June?

Another practical option is paying for holidays in instalments. easyJet holidays, for example, allows you to secure a trip with a small deposit and pay the rest over time—interest-free. TUI and others offer similar schemes.

Avoid putting holidays on credit cards if you can—the interest adds up fast. Get organised now, and you’ll enjoy your break far more knowing it’s paid for.https://www.easyjet.com/en/holidays/info/paying-for-your-holiday

https://www.linkedin.com/in/richardbandrews/